All Categories

Featured

Table of Contents

The method has its own advantages, but it likewise has problems with high costs, intricacy, and extra, causing it being considered as a fraud by some. Limitless banking is not the finest plan if you require only the financial investment element. The boundless financial idea revolves around the use of entire life insurance coverage plans as a monetary tool.

A PUAR permits you to "overfund" your insurance coverage policy right up to line of it ending up being a Changed Endowment Contract (MEC). When you make use of a PUAR, you quickly boost your cash money worth (and your survivor benefit), therefore increasing the power of your "financial institution". Further, the more money worth you have, the better your passion and dividend payments from your insurance policy company will certainly be.

With the rise of TikTok as an information-sharing platform, economic recommendations and methods have located an unique way of dispersing. One such strategy that has been making the rounds is the unlimited banking concept, or IBC for brief, gathering endorsements from celebrities like rap artist Waka Flocka Flame - Wealth building with Infinite Banking. While the method is presently prominent, its origins trace back to the 1980s when financial expert Nelson Nash presented it to the globe.

What are the risks of using Financial Independence Through Infinite Banking?

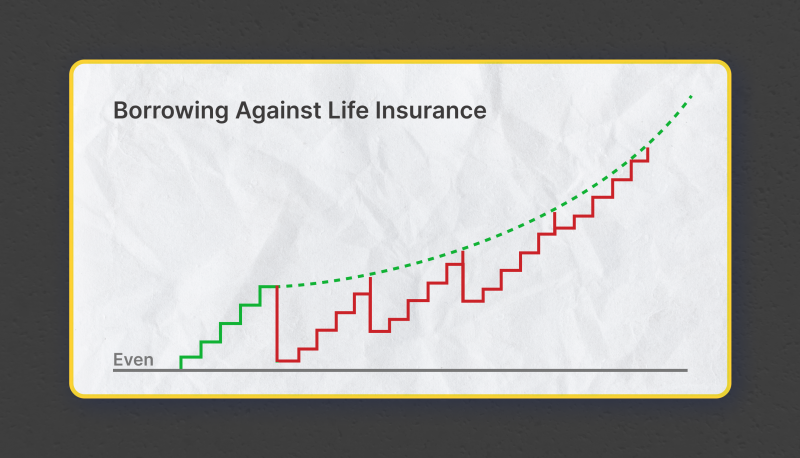

Within these policies, the money value expands based upon a price set by the insurance provider. When a significant cash worth builds up, insurance policy holders can acquire a cash worth finance. These car loans differ from standard ones, with life insurance policy acting as collateral, indicating one could lose their protection if borrowing excessively without adequate cash worth to sustain the insurance costs.

And while the attraction of these policies appears, there are innate constraints and dangers, requiring thorough money value monitoring. The method's authenticity isn't black and white. For high-net-worth individuals or local business owner, specifically those utilizing approaches like company-owned life insurance (COLI), the advantages of tax breaks and compound growth might be appealing.

The attraction of unlimited financial does not negate its obstacles: Expense: The fundamental need, a long-term life insurance policy policy, is more expensive than its term equivalents. Eligibility: Not every person receives whole life insurance policy due to rigorous underwriting procedures that can omit those with details health or way of life problems. Complexity and danger: The intricate nature of IBC, coupled with its dangers, may hinder lots of, specifically when easier and much less high-risk choices are readily available.

What are the common mistakes people make with Financial Leverage With Infinite Banking?

Assigning around 10% of your monthly income to the plan is just not practical for the majority of people. Component of what you read below is merely a reiteration of what has actually already been claimed over.

Before you obtain on your own into a situation you're not prepared for, know the complying with first: Although the concept is commonly sold as such, you're not really taking a car loan from yourself. If that held true, you wouldn't need to settle it. Rather, you're obtaining from the insurance policy firm and need to repay it with rate of interest.

Some social media blog posts advise utilizing money worth from whole life insurance to pay down credit score card debt. When you pay back the funding, a part of that rate of interest goes to the insurance firm.

How secure is my money with Cash Value Leveraging?

For the very first a number of years, you'll be paying off the payment. This makes it exceptionally difficult for your policy to collect value throughout this time. Unless you can pay for to pay a few to numerous hundred dollars for the next decade or more, IBC will not function for you.

Not every person must depend entirely on themselves for economic security. Borrowing against cash value. If you require life insurance, here are some useful suggestions to consider: Consider term life insurance coverage. These policies offer insurance coverage during years with substantial economic obligations, like home mortgages, trainee car loans, or when caring for young kids. Make certain to search for the very best price.

What are the most successful uses of Cash Flow Banking?

Envision never having to fret regarding bank car loans or high passion prices once again. That's the power of unlimited financial life insurance policy.

There's no set lending term, and you have the freedom to determine on the payment routine, which can be as leisurely as paying off the funding at the time of fatality. This adaptability expands to the maintenance of the loans, where you can select interest-only repayments, maintaining the car loan equilibrium level and convenient.

What is the minimum commitment for Wealth Management With Infinite Banking?

Holding cash in an IUL dealt with account being credited interest can typically be much better than holding the cash on down payment at a bank.: You've always imagined opening your own pastry shop. You can obtain from your IUL policy to cover the preliminary expenses of renting out a space, purchasing devices, and employing team.

Individual fundings can be acquired from standard financial institutions and credit report unions. Borrowing money on a credit rating card is typically extremely expensive with yearly percentage rates of rate of interest (APR) often reaching 20% to 30% or more a year.

Latest Posts

Infinite Banking With Iul: A Step-by-step Guide ...

Infinite Financial Group

Hybrid Debt & Mortgage Arbitrage, Become Your Own Bank